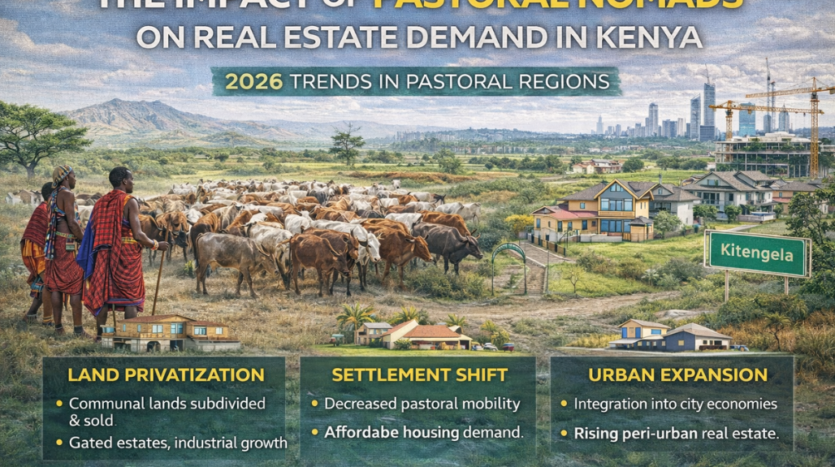

The Impact of Pastoral Nomads on Real Estate Demand in Kenya

Kenya’s real estate landscape is evolving rapidly, shaped by urban expansion, infrastructure growth, and shifting land-use patterns. One often overlooked factor is the influence of pastoral nomadic communities, whose traditional grazing practices and changing settlement patterns directly affect land demand, pricing trends, and property development. Understanding this dynamic is essential for investors, developers, and policymakers navigating Kenya’s property market in 2026.

Understanding Pastoral Nomadism in Kenya’s Land Economy

Pastoral nomads such as Maasai, Samburu, Turkana, and Borana communities traditionally rely on seasonal livestock movement across communal rangelands. Historically, these areas were sparsely developed, but urban expansion and privatization have reshaped land ownership systems.

As land becomes titled and subdivided, many pastoral areas especially around Kajiado, Kitengela, Machakos, and Laikipia are transitioning from communal grazing zones into residential estates, industrial parks, and agricultural investments.

Land Privatization and Rising Real Estate Demand

One of the biggest drivers of real estate demand in pastoral regions is land privatization. Over the past few decades:

- Communal land has been subdivided into individual titles.

- Landowners increasingly sell parcels to investors and developers.

- Rising urban demand pushes land prices higher near cities.

Research shows that privatization has allowed pastoral landowners to sell property individually, accelerating residential and industrial expansion around Nairobi’s outskirts.

This process has transformed places like Kitengela and Rongai into booming real estate hubs with gated estates and commercial developments.

Sedentarization and Emerging Settlement Patterns

As land becomes fenced and subdivided, pastoral mobility decreases. Many communities shift toward permanent settlement, which creates new housing demand and infrastructure needs.

This shift drives real estate growth in several ways:

- Increased need for affordable housing and small plots.

- Demand for schools, healthcare facilities, and retail spaces.

- Expansion of road networks and utilities.

Studies indicate that reduced grazing land and urban pressure have pushed pastoral households toward sedentary lifestyles and land ownership structures similar to mainstream real estate markets.

Land Use Conflicts and Investment Risks

Despite the opportunities, investors should be aware of challenges affecting real estate in pastoral zones:

- Conflicts over grazing corridors and land boundaries.

- Climate pressures leading to migration into new areas.

- Community land governance complexities.

Pastoral land systems often involve customary rights and communal governance, which may not align with formal title registration.

This means buyers must conduct thorough due diligence, including community consultations and legal verification.

Urban Expansion and the Rural–Urban Interface

In peri-urban regions, pastoralists increasingly integrate into urban economies by:

- Selling land to developers.

- Investing profits in new land or businesses.

- Supplying meat and dairy to urban markets.

Research shows pastoralists sometimes capitalize on rising land values by subdividing property for residential development or investing in urban land markets themselves.

This integration accelerates real estate demand in emerging satellite towns, creating opportunities for investors targeting long-term appreciation.

Investment Opportunities in Pastoral Regions

Investors looking at pastoral areas should focus on:

1. Peri-Urban Residential Development

Areas near expanding cities offer high appreciation potential as pastoral land transitions to housing.

2. Agricultural and Mixed-Use Projects

Land conversion creates opportunities for agri-estates, eco-tourism, and mixed developments.

3. Infrastructure-Driven Growth

Roads, schools, and utilities increase property values in previously remote pastoral regions.

Final Thoughts: A Complex but Promising Market

Pastoral nomadism is reshaping Kenya’s real estate sector in unexpected ways. Land privatization, settlement changes, and urban integration are transforming traditional grazing areas into fast-growing investment zones.

For smart investors in 2026:

- Understand community land dynamics.

- Monitor urban expansion corridors.

- Invest early in transitioning pastoral regions.

As Kenya balances development with cultural heritage and sustainable land use, pastoral regions will remain one of the most dynamic and influential drivers of real estate demand.